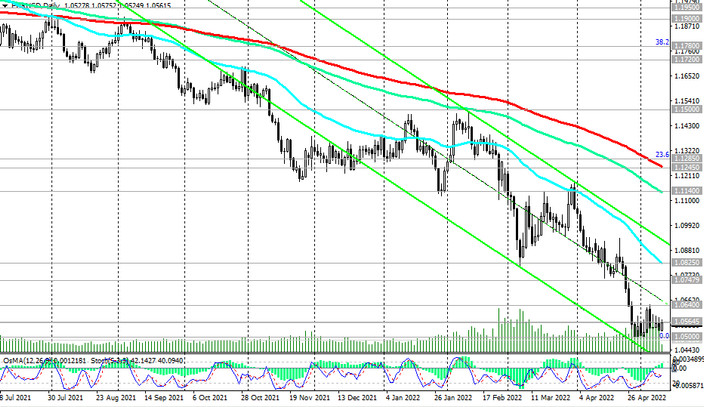

The euro will remain under strong pressure, and the EUR/USD pair is under the threat of a new fall below 1.0500 (as economists say, "towards euro parity with the dollar") not only because of the weak euro, but also the strengthening dollar.

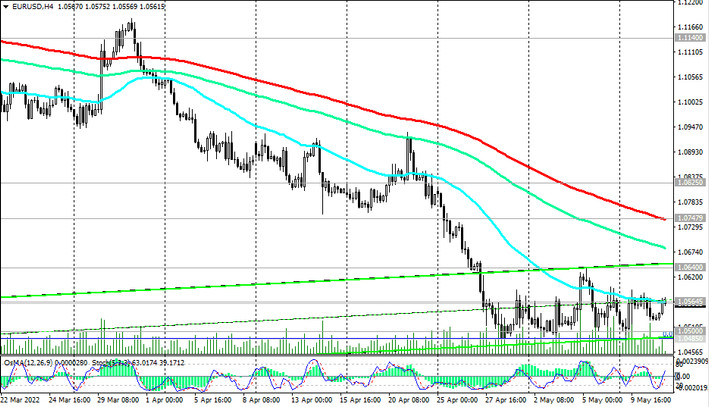

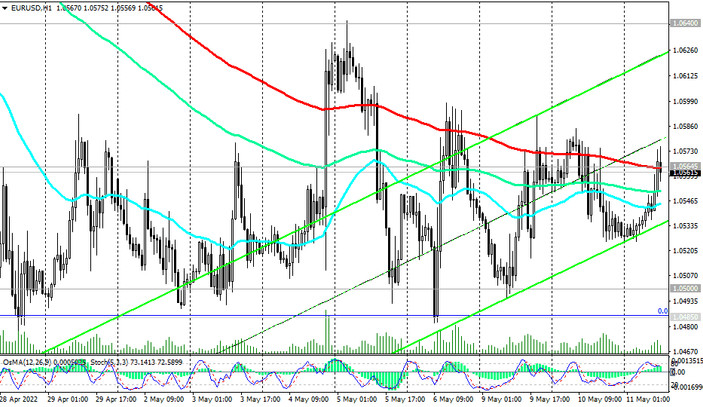

A strong negative impulse prevails. And yet, on the time frames (daily, 4-hour, 1-hour) technical indicators OsMA, Stochastic went over to the side of the buyers, signaling the possibility of continuing an upward correction with targets at the resistance levels 1.0748 (EMA200 on the 4-hour chart), 1.0825 (EMA50 on the daily chart).

This scenario will develop after the breakdown of resistance levels 1.0565 (EMA200 on the 1-hour chart), 1.0640 (local maximum).

Further growth, in our opinion, is unlikely. EUR/USD is in the zone of a long-term bearish market, and a breakdown of the support levels 1.0500, 1.0470 will confirm our assumption of a further decline in the pair.

Support levels: 1.0500, 1.0470, 1.0400, 1.0350, 1.0300

Resistance levels: 1.0565, 1.0640, 1.0700, 1.0748, 1.0800, 1.0825, 1.0900, 1.1000, 1.1140, 1.1245, 1.1285

Trading Recommendations

Sell Stop 1.0520. Stop Loss 1.0610. Take-Profit 1.0500, 1.0470, 1.0400, 1.0350, 1.0300

Buy Stop 1.0610. Stop Loss 1.0520. Take-Profit 1.0640, 1.0700, 1.0748, 1.0800, 1.0825, 1.0900, 1.1000, 1.1140, 1.1245, 1.1285