The COVID-19 virus has sent global markets into terrible chaos where massive daily sales and drops, changed by quick, but short-lived recoveries, now deepen the overwhelming uncertainty, affecting investments of each small or large trader.

Despite the fact that more and more traders are trying to take advantage of this situation, unfortunately, we see that strategies that worked in similar cases (crises) in history are now failing and the mentioned efforts of traders now look more rather as a trial and error than trading based on rational procedures.

Volatility effects on the global market

Despite the fact that information about coronavirus was known even before the pandemic erupted in the world and therefore, traders could react to this fact in advance, markets remain highly turbulent these days as not only in the most affected Europe but also in the United States, a massive economic slowdown is seen as a result of the actual negative and unavoidable spreading of this illness.

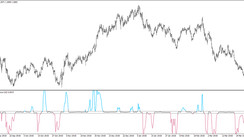

The development of VIX volatility index (higher values show higher nervousness on the markets) below is also not pointing to this trend calming down over the next days. Conversely, over the last days, the VIX index is starting to strengthen again, meaning that even the government promises about the provision of aid and investments for the support of entrepreneurs, affected adversely by COVID-19, is not enough and is also demonstrated in global indices (see the charts below), falling more and more deeply thanks to this fact, so even the volatility in global markets is rising.

Chart – VIX index

How volatility affected indices of respective countries

S&P500 – U.S stock index

NIKKEI225 – Japan stock index

CAC40 – French stock index

DAX30 – German stock index

FTSE100 – UK stock index

Albeit it may look like COVID-19 affects respective economies in the same way and with identical strength of such impact, thanks to the charts above, the real number tells us a different story. It’s clear that the coronavirus illness has a negative impact on each affected country, however, if we follow integers, it’s evident that certain markets are affected more than the others.

A very interesting fact of these days is that despite the fact that Italy is now being considered as a country with the worst coronavirus pandemic progress when it comes to the number of people infected, top Italian stocks (including Italian stock index) are, when it comes to the value of maximum percentage drop (by ca 36% from February 20, 2020), in a significantly better condition than the top equities of Germany (maximum drop from February 20, 2020– by ca 42.6%) or France (maximum drop from February 20, 2020– by ca 42.6%).

Conclusion

Extreme volatility affects each global market, and it’s not an exception that even such stable indices like Dow Jones, S&P500, or NIKKEI225 are able to lose more than 10% of their value in just a single day. Overwhelming nervous sentiment among investors who do not know what to expect is now bringing unprecedented volatility to financial markets we can see only at the riskiest instruments under standard conditions, and if the situation related to coronavirus does not change, we will see more of it.

If you want to try trading CFDs, Purple Trading is offering major symbols. You can check it here.

If you would like to try out trading with top tier trading conditions and professional forex broker, don’t hesitate to try our demo account that may be open on our website completely for free and free of any risk: www.purple-trading.com

We wish you many profitable trades!

About the Author

Team Purple Trading

Purple Trading is a true and 100% fair ECN / STP forex broker providing direct access to the real market. High speed orders execution, no trade-offs, no limits for any type of trading, the most advanced trading technologies. Explore more about Purple Trading at www.purple-trading.com .

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76,6% of retail investors lose their capital when trading CFDs with this provider. This value was determined within the period from 01 January 2019 to 31 December 2019. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Trading forex exchange with margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. You could lose part or all of your initial investment and therefore you should not invest money that you cannot afford to lose. Seek independent advice if you have any doubts.

Any opinions, news, research, analysis, prices, or other information contained on this material is provided as general market commentary, and does not constitute investment advice. L.F. Investment Limited will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Purple Trading is a trade name owned and operated by L.F. Investment Limited., a licensed Cyprus Investment Firm regulated by the CySEC lic. no. 271/15.